Paris Agreement: Pulling Out May Not Help Coal Industry

President Donald Trump announced that the United States was withdrawing from the Paris Climate Accord and said that the agreement had hurt the U.S. economy. With this move, Trump has delivered on one of his major campaign promises; however, the decision may well fall short in resuscitating the ailing coal industry. This is not the first time that President Trump has come to the coal industry’s rescue. Earlier this year, he announced his Energy Independence Policy that he hoped would benefit the coal industry. This new policy aims to loosen environmental regulations on coal companies put in place under the Obama administration. In February, President Trump eliminated the Obama-era Steam Protection Rule. Both houses of Congress voted to get rid of the rule that barred coal companies from dumping waste into local waterways.

But why does the coal industry need rescuing, and will President Trump’s efforts help? (See also: How is Energy Reacting to President Trump?)

Why is Coal Industry in Trouble?

"The Paris climate accord is simply the latest example of Washington entering into an agreement that disadvantages the United States, to the exclusive benefit of other countries, leaving American workers, who I love, and taxpayers to absorb the cost in terms of lost jobs, lower wages, shuttered factories and vastly diminished economic production," President Trump said. while withdrawing from the Paris agreement.

Many Republican legislators blame President Obama for the state of the coal industry. In a bid to reduce carbon pollution, in 2015 President Obama announced the Clean Power Plan (CPP) mandating higher efficiency and stringent greenhouse emission regulation for fossil fuel based power plants. The National Mining Association estimated a decrease of 242 million short tons in the coal production due to the CPP.

President Obama followed that up with a moratorium on leases for coal mined from federal lands in January 2016. In his State of the Union address President Obama said that he was going to “push to change the way we manage our oil and coal resources, so that they better reflect the costs they impose on taxpayers and our planet.” His critics disagreed, arguing this would cripple the struggling industry further.

But there are other causes too that have perhaps caused more harm to the coal industry. As prices of natural gas plummeted over the past few years, it has become a strong substitute to coal. Cheaper and cleaner gas alternatives led to a switch by many states from coal based electricity generation to gas. A December 2016 analysis by the Brookings Institution found that coal’s share in electricity generation fell from 54% in 1990 to 30% in 2016, while natural gas energy generation increased from 11% to 34% over the same period. This is the biggest reason why a shift back to coal may not necessarily yield the kind of economic boost that President Trump is hoping for.

There is, however, some good news on that front. The EIA expects that higher natural gas prices will put downward pressure on electricity generated by natural gas, reverse the trend and increase coal-based electricity generation by a percentage point in 2017. But just a percentage point.

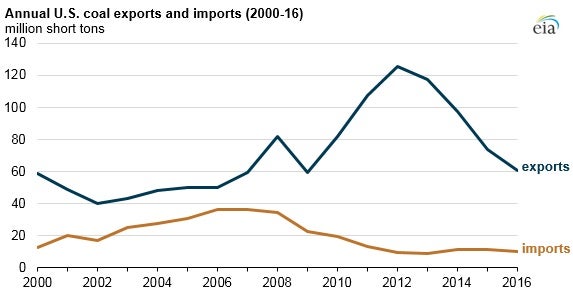

Slower demand for U.S. coal is squeezing exports, another factor that is pushing the industry further into doldrums. Even though the U.S. exported 60.3 million short tons of coal in 2016, this was a far cry from the record 125.7 million short tons it exported just five years ago. The EIA admits that lower mining costs, cheaper transportation and more favorable exchange rates are giving countries like Australia, Indonesia, Russia, Colombia and South Africa and edge over the U.S.

How Deep are Coal Industry's Troubles?

The coal industry saw its decade highs in 2008 but has witnessed a steady decline since then. In fact, it is hurting so badly that coal production in the country saw an 18% year over year drop in 2016 to 739 million short tons, its lowest level since 1978.

This decline has resulted in companies closing mines. The current tally of 853 stands nearly 41% lower than the peak of 1458 operational mines across the country in 2008. The employee figure for 2015, was 12% lower than the 74,930 people employed in the previous year and the lowest in 37 years.

Struggling with lower production and cutting costs, coal mining companies are finding it difficult to stay afloat. Some of the biggest names in the business like Peabody Energy, Arch Coal Inc.(ARCH

) , Walter Energy and Alpha Natural Resources Inc., have all filed for bankruptcy. An SNL report last year found that more than two-thirds of the coal produced in the country came from a company that had filed for bankruptcy.Where is Coal Country?

According to data from the U.S. Energy Information Administration (EIA), in 2015 there were 853 coal mines across 26 states in the country. These include both underground and surface mines that yield both anthracite and bituminous coal. These mines on average also employed close to 65,971 people that year who, along with another nearly 4,000 associated workers in the industry, earned an annual mean wage of $57,820 at a mean hourly rate of $27.8, according to data from the Bureau of Labor Statistics.

In 2015, Kentucky with 210 mines had the largest number of coal mines, followed by 195 in Pennsylvania and 151 in West Virginia. In terms of employment, West Virginia employed close to 15,500 people, the highest among all coal producing states, followed by 9,821 in Kentucky and 6,635 employees in 16 mines in Wyoming.

The Bottom Line

While domestic regulation has had an impact on the economics of coal production in the U.S., a major part of the head winds came from factors that could not be controlled. Shifting away from the Paris Accord may not do much to come to the aid of the coal industry, and in turn may harm the other energy industries like solar or wind that have seen some growth in recent years, killing more jobs than creating them. Looks like this decision by President Trump won't be the shot in the arm that the coal country so badly needs.

Comments

Post a Comment